Term Insurance

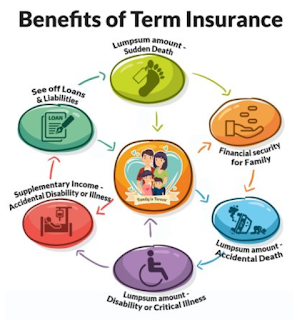

Term Insurance is an insurance plan that

provides financial coverage to the beneficiary of the insured In the event of

death of Term Insurance policy holder during the policy term, the beneficiary

can claim the benefit from the insurance company.

Term Insurance provides high coverage at low

premiums.

It is a Pure Insurance plan that gives the

lump-sum amount to its nominee in case of death. Thereby, there is no problem

living his family in further life.

Term plan doesn’t provides maturity benefit, it

provides only death benefit (some company provides return of premium in case of

survival).

Why should you take term insurance?

On Death, the nominee is given a lump-sum

amount.

This is the cheapest insurance plan available

on the monthly premium approx. 600 for a sum assured of 1crore.

In case of accidental death of the insured

person, the financial loss suffered by the family member can be compensated by

the amount received from the term insurance.

Any kind of loan that was taken by the insured,

can also be paid by the claim amount received from the term insurance.

Children's education and marriage can also be

done with the claim amount from Term Insurance. If you have term insurance, you

do not even have a child insurance plan, you will be able to get the money from

Term Insurance to your children in whatever future financial need it will be.

You can also take a child plan if you want.

In Term Insurance, a rider of disability and critical illness can also be taken separately, which provides financial assistance when it comes to Accidental Disability or any serious illness.

Misconceptions about Term Insurance: -

A lot of people have a misconception about term

insurance that this plan is not beneficial because it does not get any returns.

That's why people think that they do not need Term Insurance.

Your child's future becomes secure from.

The loan taken by you becomes secured.

If you do not stay, your family's daily

expenses are covered.

If a person earns a misfortune in the family,

then his family is facing refusal to face financial loss. So is his family able

to fulfil this financial loss? If the person earning a family is not dependent

on your income to fulfil the daily expenses and plans for the future, then what

will your family do in this situation? Your family's daily expenses, education

of children, marriage of children, will come by saying enough money to pay the instalment

of the loan taken by you. If you have Term Insurance, then all these needs may

be met by not having your family earning.

Term insurance is a plan that can meet the

financial needs of your family when you do not have it. You can take care of

the loans taken by you. Who will pay the loan in your absence? If this happens,

then your investment will be used to pay your liabilities. In this situation,

how your environment will meet your lifestyle requirements.

Will my children's future be safe in case of my

sudden death? Everyone wants a safe spirit with good education and a stable

career for their children. Money is required to ensure a secure future. This is

the reason that most of you invest in the direction of creating a rich carpus

for your child's future education. If your investment is done due to sudden

death, then the invested money will be sufficient to pay for your child's

higher education.

Term Insurance provides you solutions for all

the above needs.

Due to the low premium rates, this plan allows

you to buy a lot of insurance. And for any reason, the sum insured is paid in

case of your premature death, which is of great size (you will get an insurance

of Rs 1crore on the monthly premium of Rs 600) and resolves the financial

dilemma of your family.

Your family can use the benefits of the Term

Insurance plan to pay for your education, to pay for your children's higher

education, to pay off their liabilities to meet their life expenses. So Term

Insurance offers a solution for all your financial needs. One Term Insurance is

important that it should be a part of your financial portfolio. If you are

thinking of leaving it then once again you will see the need described above

again. I'm sure you have to be forced to focus on the importance of the plan.

How to choose better term plan:-

While taking term insurance, we should take

care of the claim settlement ratio and premium, which is more than 95% of the

claim settlement ratio of the company, we should take the term insurance of the

same company.

Claim settlement of ICICI Prudential Life

Insurance, HDFC Life Insurance, Max Life Insurance is more than 95%. You can

take term insurance from any of these three companies.

Premium: -

Term insurance depends on premium, age, health

condition, smoker, etc. The sooner you take term insurances, you have to pay

the same amount of work premium.

Payment: -

Premium Paying Term -Single, Regular, Monthly,

Quarterly, Half Yearly, Yearly.

Sum Assured:-

You will get Sum Assured 20 times your Yearly Income.

The policy term is from 5 years to 100 years.

You can also take extra rider along with this,

you will have to pay extra premium.

Comments

Post a Comment