Debt Mutual Funds: A perfect choice for

conservative investors

A common question in investor’s mind: Interest

on money lying in savings account is too low and if I park that money in a

fixed deposit, return is not great there too plus there is no flexibility.What should

I do?

The answer to this question for a conservative investor is “Invest in Debt Mutual Funds”.

The answer to this question for a conservative investor is “Invest in Debt Mutual Funds”.

What are Debt Mutual Funds?

Debt funds represent the category of mutual

funds that invest in a mix of debt or fixed income securities.

Debt securities are loans taken by either

Government or Companies. These securities have fixed maturity date and pay

fixed rate of interest.

As the Debt Mutual Funds invest in securities

with fixed interest, the returns of these funds are more predictable and less

volatile.

The returns of a debt mutual fund include

interest income and capital appreciation / depreciation in the value of the

security due to changes in market dynamics. There could be a risk element if

the Company, which has issued the debt security, defaults in timely payment of

interest or the principal.

Debt securities are assigned a ‘credit

rating’, which helps assess the ability of the issuer of the securities /

bonds to pay back their debt, over a certain period of time.

Why invest in Debt Mutual Funds?

Variety: Debt funds offer a wider variety – you can

invest in debt funds that invest only in Government Securities or the ones that

invest in securities of Companies. Further, there are debt funds with short

term profile as well as long term ones.

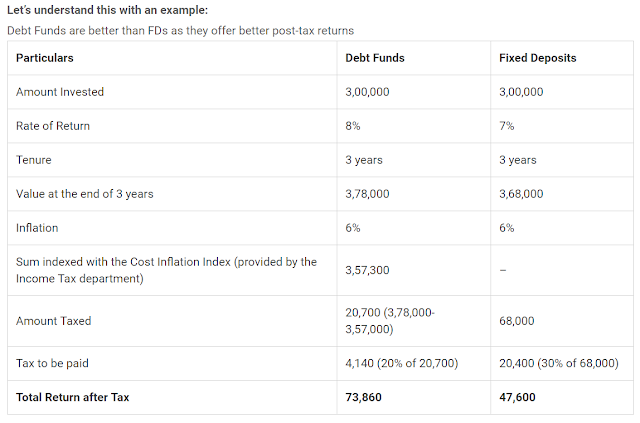

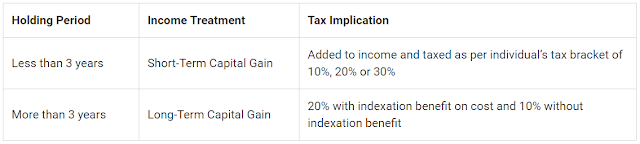

Tax efficient: Debt funds are tax efficient than fixed

deposits. If held for over three years, the gains are treated as long-term

capital gains and taxed at a lower rate of 20% after indexation. Indexation

takes into account the inflation during the holding period and accordingly

raises the acquisition price of the asset. Because of this you pay very nominal

amount of tax compared to fixed deposits.

Which category of Debt Mutual Funds you should

invest in?

Ultra short-term funds if you have short term surplus for a time

period of approximately 0 to 9 months.

Credit Risk Funds if you are looking for lucrative returns and are

aware of the fact that these funds invest at least 65% of their investments in

less than AA-rated paper. These funds typically generate 2-3% higher returns

compared to risk-free papers as they take higher credit risk by investing in

lower-rated papers. Market price of such securities goes up as and when their

ratings move up, and they offer a benefit of capital gains.

Fixed Maturity Plans (FMPs) are apt for 3 years if you are looking for predictable returns for a particular tenure. Their objective is to provide steady returns over a fixed-maturity period and are suitable for investors who wish to avoid interest rate risk and are willing to invest in safer debt instruments which would earn marginally higher than savings account and bank fixed deposit.

Fixed Maturity Plans (FMPs) are apt for 3 years if you are looking for predictable returns for a particular tenure. Their objective is to provide steady returns over a fixed-maturity period and are suitable for investors who wish to avoid interest rate risk and are willing to invest in safer debt instruments which would earn marginally higher than savings account and bank fixed deposit.

Debt Funds and Taxation.

Comments

Post a Comment